Are You Maximizing Your Ability to Manage the Costs Associated with the Employer-Sponsored Health Plan?

The nuances of a self-funded health plan

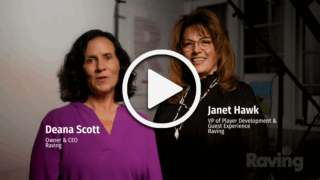

In Raving’s service expansion over the past 18 months, and as part of our new leadership, Raving now provides gaming organizations the capability to look at all areas of their operations for overall efficiencies. As a Native-owned company, it is especially important that we look at one of the largest controllable expenses impacting Tribes nationally – health benefit costs.

To help our clients address this, we’ve partnered with Tyler Moore of Face Rock Enterprises. In this first in a series of articles, Tyler will walk us through the nuances of a self-funded health plan.

Q: Basic question here. If I’m a new employee of a casino, how do you explain the differences between a self-funded health plan compared to my last job when I had Blue Cross? As an end-user, will I notice a difference in benefits?

Tyler: There may be a slight difference in the provider networks; however, we find that most of the time the self-funded plan can include a network that is very close to, if not the same as, the current provider network. In addition, we often find there to be an increase in customer service, both for the employer and the member. Overall, most employees won’t notice a difference.

Q: What’s the biggest challenge that you see in Indian country with health management? That Tribes are NOT self-funded when they should be OR they are self-funded but not efficiently so?

Tyler: I believe the bigger challenge is a Tribe that is self-funded, but not properly set up and not partnering with the right administrators and advisors. I find that a Tribe/enterprise that is currently fully-insured offers a huge opportunity to set up a self-funded program that will increase the perceived benefit while saving significant money. We just simply need to set it up correctly from the start. If a Tribe is already self-funded, but not set up correctly, we need to correct the problems, re-implement with the proper setup, and deal with the negative perceptions.

Q: How do I know if my health plan is large enough to be self-funded?

Tyler: If there are over 300 employees enrolled in the health plan … yes! If there are between 100 and 300 employees enrolled … probably still yes. If there are under 100 employees enrolled … probably not, but not out of the question.

Q: Tyler, some of our readers come from the casino operation side and some work for the Tribe through other enterprises. Typically, does the casino always fall under the Tribe’s medical program? Are there instances where the casino is separate? Does it matter if the casino has a low employment rate of Tribal members?

Tyler: I believe the most successfully run health programs have the Tribe and its enterprises under the same program, and are managed by a benefit committee with representation from each entity. However, this is not to say that you can’t have a successful program with the casino(s) separate. The principles that create a successful program can be applied to the Tribe and its enterprises if they are together or separate. The highest opportunity for savings is in a population that has a higher percentage of Tribal Members, but there is still savings potential in the groups with a lower percentage of Tribal Members.

Q: How do I know if my Tribe/Enterprise(s) is taking advantage of all the cost savings opportunities that the Federal Government provides through legislation?

Tyler: The following is a brief overview of the programs most likely to save the Tribe and its Enterprises money as it relates to health benefit costs:

Medicare Like Rates: Tribal self-funded plans are able to pay hospital claims incurred by PRC eligible employees or dependents at the Medicare rate. This would save a self-funded plan around 30-40% above any PPO discounts for these hospital claims.

Catastrophic Health Emergency Fund (CHEF):

The Tribe and its Enterprises are eligible to receive reimbursement from Indian Health Services (IHS) for any claims tied to a given

incident over $25,000 during any CHEF plan year (October 1st – September 30th).

Payor of Last Resort:

Any claims incurred through the self-funded plan are to be paid by any other payer prior to the Tribe and its Enterprises being liable. This includes any coverage through a spouse, Medicaid or Medicare.

The savings associated with the implementation of these programs will vary based on the number of PRC eligible Tribal Members enrolled in the self-funded plan; however, in an average population, you can expect a 30-40% reduction in overall plan costs.

Q: So, say my Tribe is already self-funded, how do I know if we’re taking advantage of the cost-saving programs that you listed above?

Tyler: As mentioned above …

- Partnering with an advisor that has an in-depth understanding of how to manage a self-funded health plan, knowledge of the laws supporting a Tribal self-funded plan, as well as experience in working with the PRC program.

- Selecting a third party administrator with the understanding and capabilities to coordinate the claims payment process and eligibility with the Tribe’s PRC program.

- Most importantly, there will need to be collaboration between the health plan and the Tribe’s PRC program. If you choose the right advisor, they will be best equipped to facilitate this collaboration.